Hengecat's Monthly Market Compass: July 2025

New market highs for US equities and Bitcoin! Can equities shirk the doubters? Meanwhile, inflation expectations diverge as the tariff debate looks ready to come back to center stage.

Hello again, and welcome to our Monthly Market Compass for July 2025. We send these chart heavy market summaries at the beginning of each month.

Please be aware that these notes are not investing advice and should be enjoyed as entertainment and for informational purposes only. Always do your own research. Sources can be found below each graphic.

As usual, we divide these monthly notes into several sections: an introduction and inflation watch, an economy section, a Fed focused section, and a geopolitics and commodities section. A conclusion follows these sections. Enjoy!

Introduction and Inflation Watch:

We return to markets this month with a continued focus on the dynamic between the US dollar, gold, and the US treasury markets.

Our key focus this month is the ongoing political nature of the inflation (and inflation expectations) debate and how they impact the long-term US treasury market.

To summarize our previous month’s note, the key theme of global macro is the ongoing rebalancing of global balance sheets away from long-duration US treasuries towards gold. This following a re-categorization of gold as a Tier 1 asset by the Bank for International Settlements.

This has led to an increase in gold prices, and of long-duration US treasury yields as various international asset allocators have rotated from treasuries to gold.

With the long end of the US treasury yield curve remaining high, the US is left in a tricky spot as it looks to refinance its debt at higher interest levels, which leads to a higher interest expense for the US Government.

Source: https://x.com/bravosresearch/status/1931697434708595011

This puts the US at the top of developed economies related to the percent of GDP that is needed for the interest rate expense.

Source: https://x.com/bravosresearch/status/1932101834065465539

Last month we looked at the various ways that the US could get itself out of its long-term debt situation as well at its current interest expense situation:

Fiscal Austerity

Inflation and Financial Repression

Default and/or Debt Restructuring

Asset Sales and/or Privatization of government assets

Economic Growth/”Growth Miracle”

‘Inflation’ and ‘Economic Growth’ are the only serious options for the US at the moment. (Read last month, for more.)

And generally the investing world bets strongly towards the potential of an inflation-based resolution, rather than an economic growth-based resolution. Mostly, because the level of growth the US would need is sizable.

That said, AI and cheap US energy might be a way forward on the growth side, but this growth-based outcome would need help - most immediately from the Fed in the form of rate cuts.

If the growth-based outcome doesn’t happen, then it’s likely we’ll see high inflation for the foreseeable future as the US Government prints money to meet its obligations.

Inflation expectations dictate long-duration treasury yields, which are a key input to the economic growth.

If for some reason, large parts of the US economy were able to refinance their various loans (mortgages, commercial real estate loans, bank loans, etc.), at the interest rates of the last few years, it would spur on job creation, and bolster cash flows of businesses and households throughout the economy - potentially contributing to the economic growth needed to repair the US’s debt position.

Moreover, if the US was able to refinance its debt at lower interest rate levels, it would decrease the interest rate expense it is currently paying, allowing it to pay down other obligations, with the freed up cash.

All of that is to say that the inflation debate is starting to get more political.

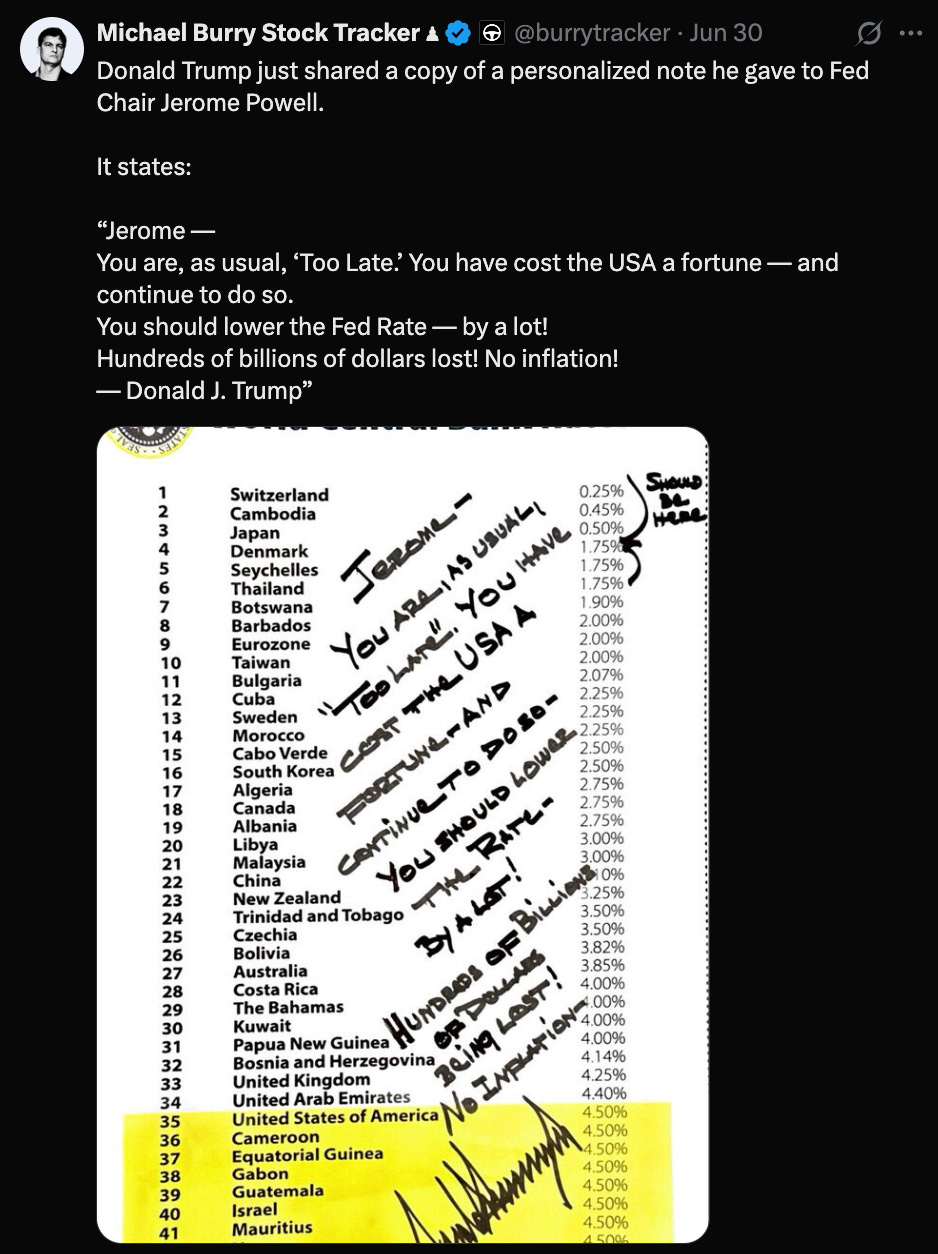

President Trump would like to see lower rates, to help the rest of the economy move along.

Source: https://x.com/burrytracker/status/1939736138693890515

Most recently, Trump is seeking a 300bp rate cut from the Fed. A rate cut size never before seen in the US. (Source)

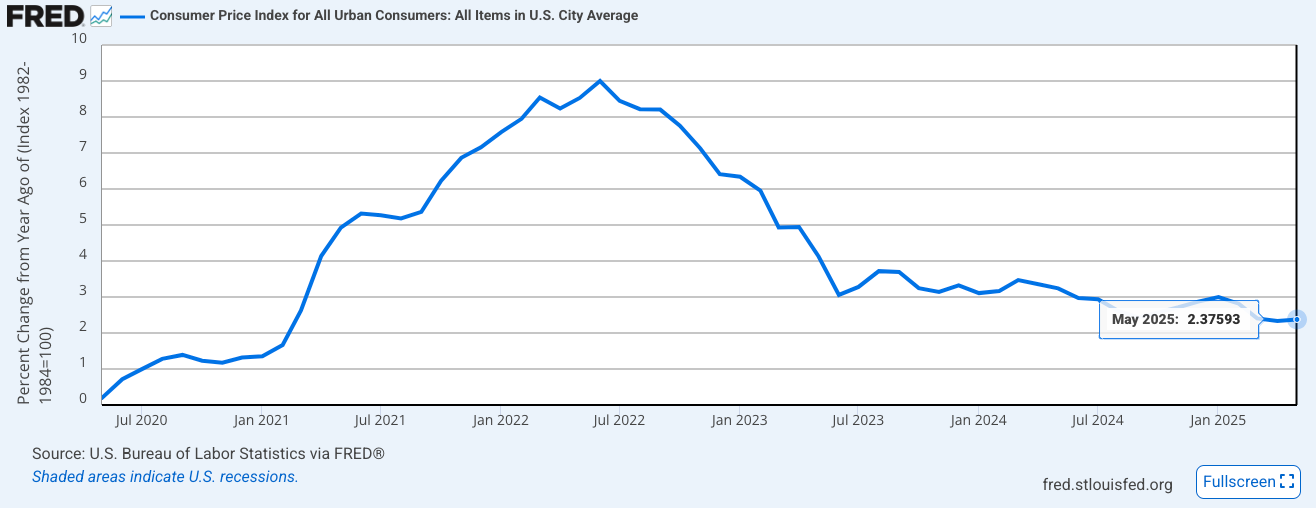

The official CPI has gradually dropped to 2.4% over the last year:

Source: https://fred.stlouisfed.org/series/CPIAUCSL

But other measures of inflation, like the Truflation measure, show current inflation much lower than the CPI figure:

Source: https://truflation.com/marketplace/us-inflation-rate

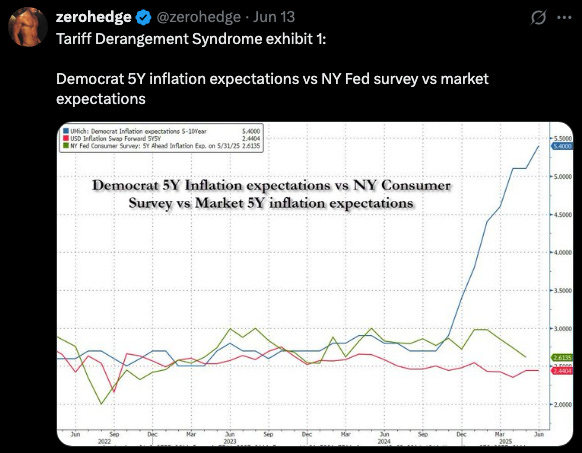

Inflation expectations are similarly a divided matter:

The University of Michigan’s Inflation Expectation measure is much higher than where inflation is currently:

Source: https://fred.stlouisfed.org/series/MICH

Comparing the University of Michigan figure to the NY Fed Consumer Survey and current Inflation Swaps, we see the disconnect.

Source: https://x.com/zerohedge/status/1933526552764969234

The result of this debate on inflation is that different groups have wildly different views on where the Fed should go next with rates.

Trump thinks rates should be much lower - as we saw above.

While others think the Fed has been so out of step for the last three years (late to raise rates after Covid, then late to lower rates when they were needed in 2022), that they are now wrong footed completely - cutting rates when they should be raising rates.

Source: https://x.com/Callum_Thomas/status/1935433860617224283

The result is that we are seeing irregular bond yield activity - that the Fed is cutting rates and long-duration US treasuries yields are rising instead of falling:

Source: https://x.com/Convertbond/status/1933886080400392518

The debate over where current inflation is, where inflation expectations should be, and where and how quickly the Fed should be taking rates all impacts the US treasury yield curve, and the entire US economy’s ability to refinance its debt:

Source: https://x.com/martypartymusic/status/1938016128447680811

Turning to the US dollar…

Keep reading with a 7-day free trial

Subscribe to Hengecat Research to keep reading this post and get 7 days of free access to the full post archives.